Some Known Questions About Simply Solar Illinois.

Some Known Questions About Simply Solar Illinois.

Blog Article

The Only Guide for Simply Solar Illinois

Table of ContentsThe 15-Second Trick For Simply Solar IllinoisSimply Solar Illinois Can Be Fun For AnyoneA Biased View of Simply Solar IllinoisExcitement About Simply Solar IllinoisSome Known Facts About Simply Solar Illinois.

Our group partners with local areas throughout the Northeast and past to supply clean, budget friendly and reliable power to promote healthy and balanced areas and maintain the lights on. A solar or storage task supplies a variety of advantages to the neighborhood it serves. As technology advancements and the price of solar and storage decrease, the economic advantages of going solar remain to increase.Support for pollinator-friendly environment Habitat restoration on polluted sites like brownfields and landfills Much required color for animals like lamb and poultry "Land financial" for future farming usage and dirt top quality renovations Due to climate modification, severe climate is coming to be a lot more frequent and disruptive. Because of this, homeowners, organizations, neighborhoods, and energies are all becoming increasingly more interested in securing energy supply remedies that use resiliency and power safety.

In 2016, the wind energy sector directly used over 100,000 full-time-equivalent employees in a range of capabilities, including production, task development, construction and turbine installment, operations and upkeep, transportation and logistics, and financial, legal, and consulting solutions [10] More than 500 factories in the USA produce parts for wind generators, and wind power task installations in 2016 alone represented $13.0 billion in financial investments [11] Ecological sustainability is an additional essential vehicle driver for businesses purchasing solar energy. Lots of firms have robust sustainability objectives that include decreasing greenhouse gas emissions and utilizing much less sources to aid minimize their influence on the natural surroundings. There is a growing seriousness to attend to climate modification and the pressure from consumers, is arriving degrees of companies.

About Simply Solar Illinois

As we come close to 2025, the combination of photovoltaic panels in industrial tasks is no much longer just a choice yet a calculated requirement. This blogpost digs into just how solar power jobs and the diverse advantages it gives business structures. Photovoltaic panel have actually been made use of on residential structures for years, however it's only recently that they're becoming extra usual in business building.

In this article we talk about just how solar panels work and the benefits of making use of solar energy in industrial buildings. Power expenses in the United state are enhancing, making it extra pricey for services to run and extra tough to intend in advance.

The U - Simply Solar Illinois.S. Energy Info Management anticipates electric generation from solar to be the leading resource of growth in the united state power industry with completion of 2025, with 79 GW of brand-new solar capacity predicted ahead online over the next 2 years. In the EIA's Short-Term Energy Overview, the firm said it anticipates sustainable power's overall share of electricity generation to rise to 26% by the end of 2025

Simply Solar Illinois Fundamentals Explained

The photovoltaic or pv solar cell absorbs solar radiation. The cords feed this DC electrical energy right into the solar inverter and convert it to alternating power (AC).

There are several ways to store solar power: When solar energy is fed into an electrochemical battery, the chain reaction on the battery components maintains the solar power. see here In a reverse response, the current leaves from the battery storage for usage. Thermal storage space makes use of mediums such as molten salt or water to keep and take in the warmth from the sun.

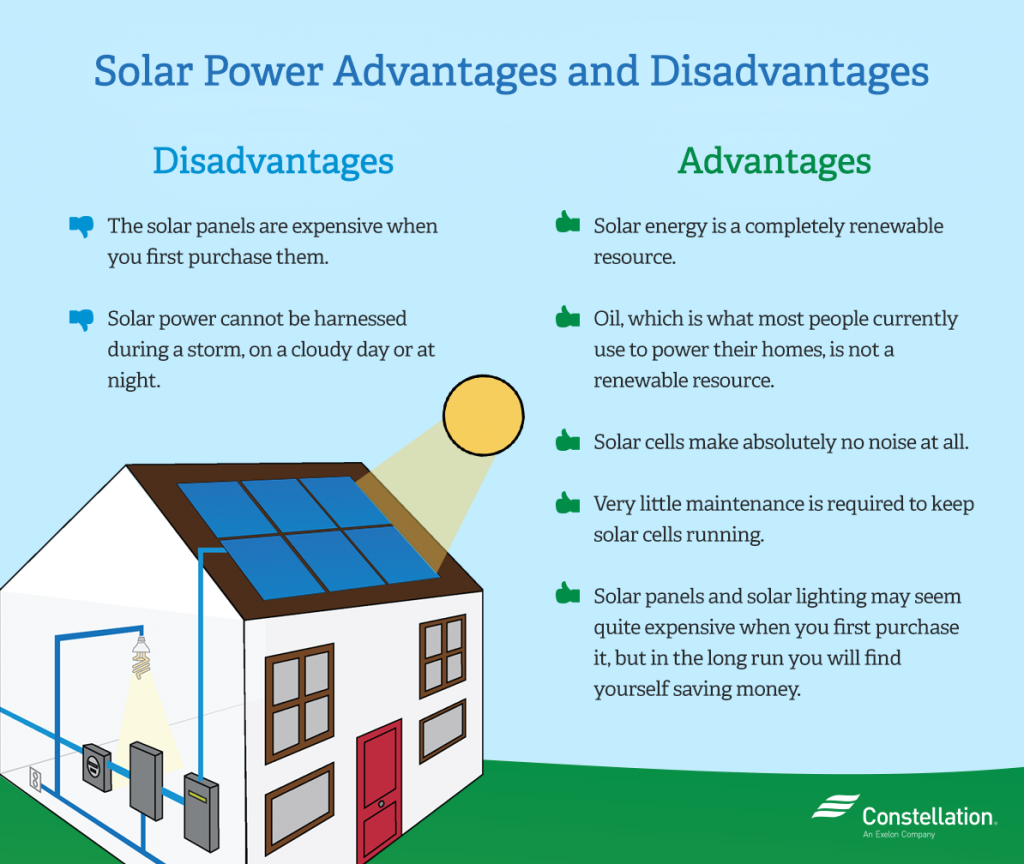

Solar panels significantly minimize energy expenses. While the preliminary financial investment can be high, overtime the cost of setting up solar panels is redeemed by the money saved on electrical power costs.

The smart Trick of Simply Solar Illinois That Nobody is Discussing

By mounting solar panels, a brand reveals that it respects the atmosphere and is making an initiative to reduce its carbon footprint. Buildings that rely completely on click to find out more electric grids are prone to power outages that take place throughout poor climate or electrical system malfunctions. Photovoltaic panel installed with battery systems allow business buildings to continue to function throughout power blackouts.

The Single Strategy To Use For Simply Solar Illinois

Solar energy is one of the cleanest types of power. In 2024, home owners can benefit from government solar tax obligation motivations, permitting them to offset nearly one-third of the purchase price of a solar system through a 30% tax credit score.

Report this page